Does homeowners’ insurance cover stair lifts and elevators in case of damage?

Table of Contents

- Key takeaways:

- How homeowners’ insurance applies to stair lifts and elevators

- What counts as covered damage?

- Why warranties matter more than insurance for repairs

- The role of Medicare, Medicaid, and health insurance

- What affects coverage limits under homeowners’ insurance?

- Choosing the right type of stairlift and installer

- Balancing homeowners’ insurance and stairlift insurance

- Making the right choice for your California home

- FAQs

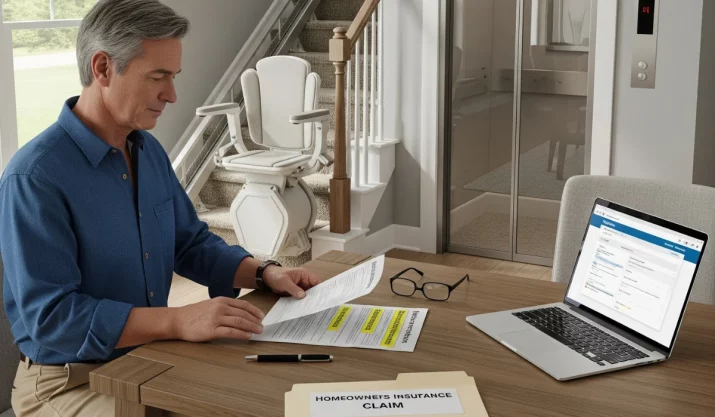

Installing a stair lift or home elevator in your California home improves safety and independence. But many homeowners ask: Does homeowners’ insurance cover stair lift damage?

Standard homeowners’ policies usually cover fire, theft, or vandalism. However, they don’t cover wear and tear, breakdowns, or poor maintenance. That’s why warranties or stair lift insurance matter. Understanding the difference helps you avoid surprise repair bills.

In this guide, we explain how homeowners’ insurance applies to stair lifts and elevators. You’ll learn what damage is covered, why warranties are often better for repairs, the role of Medicare and Medicaid, how coverage limits work, and tips for choosing the right stair lift and installer. We’ll also show how to balance homeowners’ insurance with stair lift warranties.

Key takeaways:

- Homeowners insurance can cover your stair lift or home elevator if the damage comes from a covered event such as fire, theft, or accidental damage.

- Stairlift warranties and service plans usually exclude routine repairs and mechanical failures. However, they specifically cover those issues.

- The payment you get from your insurance will depend on coverage limits, deductibles, and liability coverage.

- The type of stair lift you choose and the installer you hire significantly affect your warranty and future costs.

How homeowners’ insurance applies to stair lifts and elevators

Installing a stair lift usually makes it part of your home. Like built-in cabinets or plumbing, the lift becomes a permanent fixture. Because of this, many insurance policies list it under building coverage instead of personal property.

Still, home insurance policies vary. Some insurance providers cover stair lifts automatically. Others may require you to raise your coverage limits. If you live in an older California home that already needs several home modifications, checking your policy is even more critical.

For example, a plan in Northern California may cover wildfire damage but exclude electrical surges from outages. Reviewing your policy now helps you avoid costly surprises.

What counts as covered damage?

Most insurance companies cover stair lifts, chair lifts, and home elevators when damage comes from insured risks, such as:

- Fire or smoke damage

- Theft or vandalism

- Storm damage

- Sudden accidental damage

For example, if a tree branch crashes through your roof and damages your stair lift, your insurance company will usually help after you pay your deductible. The same goes if a burglar damages your home elevator during a break-in.

Insurance doesn’t cover every problem. If your stair lift wears out over time or you damage it while trying to fix it yourself, you’ll pay the cost. That’s why many homeowners use stair lift warranties or service plans from the installer to cover regular maintenance and repairs.

Liability coverage is another factor. If someone else gets hurt using your lift, your homeowners’ policy may help. Without it, you might be responsible for their medical bills or legal costs.

Why warranties matter more than insurance for repairs

Homeowners’ insurance is most effective for big events such as fire or vandalism. But most stair lift issues come from daily use, not disasters. If you or a loved one with disabilities will use the stairlift daily, you need to get a stairlift warranty. Under a stairlift warranty, you can get protection from common stairlift issues such as:

- Battery replacements

- Motor or track repairs

- Electrical problems

- Routine service visits

Most new stair lifts include at least a one-year warranty, and many installers offer extended coverage. Extended stair lift insurance or warranties can protect you from costly repairs, especially if you use the lift often.

When buying a stair lift in California, ask how long the warranty lasts, what it covers, and whether it includes labor costs. These details vary, and the installer you choose can significantly affect future repair costs.

The role of Medicare, Medicaid, and health insurance

A common question is whether Medicare or health insurance will help pay for a stair lift. The short answer is no. Medicare and most health insurance plans don’t cover stair lifts or elevators because they see them as home upgrades, not medical equipment.

In some cases, Medicaid can help, but it depends on the state and the program. In California, specific Medicaid-funded programs may cover part of the cost if a doctor says you need the lift for mobility. Still, the rules are strict, and not everyone qualifies.

So if you’re planning to buy a stair lift, don’t count on Medicare or health insurance to pay for it. Instead, look into warranties, service plans from your installer, or even your homeowners’ insurance for protection.

What affects coverage limits under homeowners’ insurance?

Even if your home insurance policy includes stair lift damage coverage, you still need to check the coverage limits. Three key factors affect this:

- Coverage limits: Most policies have limits that may not match the cost of a stair lift or home elevator. A complete replacement could cost more than your coverage allows.

- Deductible: You must pay your deductible before insurance helps. If your deductible is $2,500 and the repair is $1,800, you’ll pay out of pocket.

- Premiums: Filing too many claims can raise your premiums. Many homeowners save insurance claims for major accidents and rely on warranties for everyday repairs.

This balance matters in California cities like San Francisco, where stair lifts often cost more than in rural areas.

Choosing the right type of stairlift and installer

The type of stairlift you select can affect both warranty protection and insurance coverage. Straight stairlifts are often simpler and less expensive, while curved or custom lifts may require more detailed insurance documentation. Wheelchair lifts and home elevators usually come with higher repair costs, so strong warranty coverage is key.

Working with a trusted installer makes the process easier. A professional installer explains warranty details, outlines your repair options, and helps with insurance paperwork. Avoid DIY installations, which can void warranties and leave you without insurance coverage if something goes wrong.

Balancing homeowners’ insurance and stairlift insurance

The best protection comes from using homeowners’ insurance and stair lift insurance together. Here’s how they work:

- Homeowners insurance: Covers major perils such as fire, storms, theft, or accidental damage.

- Stairlift insurance or warranty: Covers wear and tear, mechanical failures, and typical repair costs.

- Installer service plans: Provide regular check-ups and maintenance to prevent breakdowns.

This approach protects you from both major and minor problems with your mobility equipment.

Making the right choice for your California home

Your stair lift or home elevator isn’t just for convenience. It’s part of your independence. Protect it by knowing what homeowners’ insurance covers and when a stair lift warranty or service plan is the better option.

At California Mobility, we help families across the state stay safe at home with stair lifts, wheelchair lifts, and home elevators. We also guide you through warranty and service plan options so you can feel confident about your investment.

If you’re ready to install a new stair lift or protect the one you already have, contact us today or request a free quote. Our team will help you choose the right mobility device for your home and guide you through warranty and insurance options.