Pros and Cons of Long-Term Care Insurance: Is It Worth It?

Table of Contents

Many people are unsure if they need long-term care insurance. If you are one of these people, this article will give you the information you need to help determine if it is worth it for you.

Long-term care insurance offers a way to protect oneself and one’s family from the financial disaster that could be incurred by needing long-term care. The problem is, many people are not aware of the need for such protection until it is too late – but with proper planning, these hefty costs can be avoided.

Here’s what you need to know about long-term care insurance.

What Long-Term Care Insurance Is

Even if you feel fit and healthy right now, chances are that you will need help taking care of yourself as you age, regardless of whether you are dealing with serious health issues. Of course, these health issues are certainly going to exacerbate the need for good care.

Sure, you can pay for these expenses out of pocket – or worse, turn a blind eye to your savings and hope your family will be able to foot the bill as you get older. However, paying for long-term care insurance is a good way to make sure you are covered as you get older. It can also be used to pay for more specialized care, such as the care you might receive if you have a chronic medical condition, a disorder like Alzheimer’s disease, or a disability.

Most long-term care insurance policies will reimburse you for expenses related to care in your own home, in an assisted living facility, in an adult day care facility, or in traditional nursing home care that requires you to move.

Why buy long-term care insurance? There’s a good chance that you are going to require some sort of assistance as you get older – roughly half of all Americans do, and according to data from the Urban Institute and the U.S. Department of Health and Human Services, about 14% of older adults require care for more than five years.

If you think your regular health insurance has you covered, think again – although some life insurance policies offer accelerated death benefits, that’s not the case with health insurance. It doesn’t cover any form of long-term care. Medicare won’t be of much help to you, either, since it covers only limited amounts of home health care for rehab or skilled nursing, or occasionally some short nursing home stays.

Medicaid can sometimes kick in to help pay for long-term care but you’ll have to exhaust all of your savings first – not an ideal situation.

It’s important that you consider whether you want to invest in long-term care insurance long before the need for this kind of care arises. It’s just like life or health insurance in that you can’t wait until you need coverage to buy it. Plus, you won’t qualify if you have a major, debilitating condition.

That said, lots of people wait to buy long-term care insurance until they are in their 50s or 60s – so if that sounds like you, don’t worry – there is still plenty of time to shop for coverage.

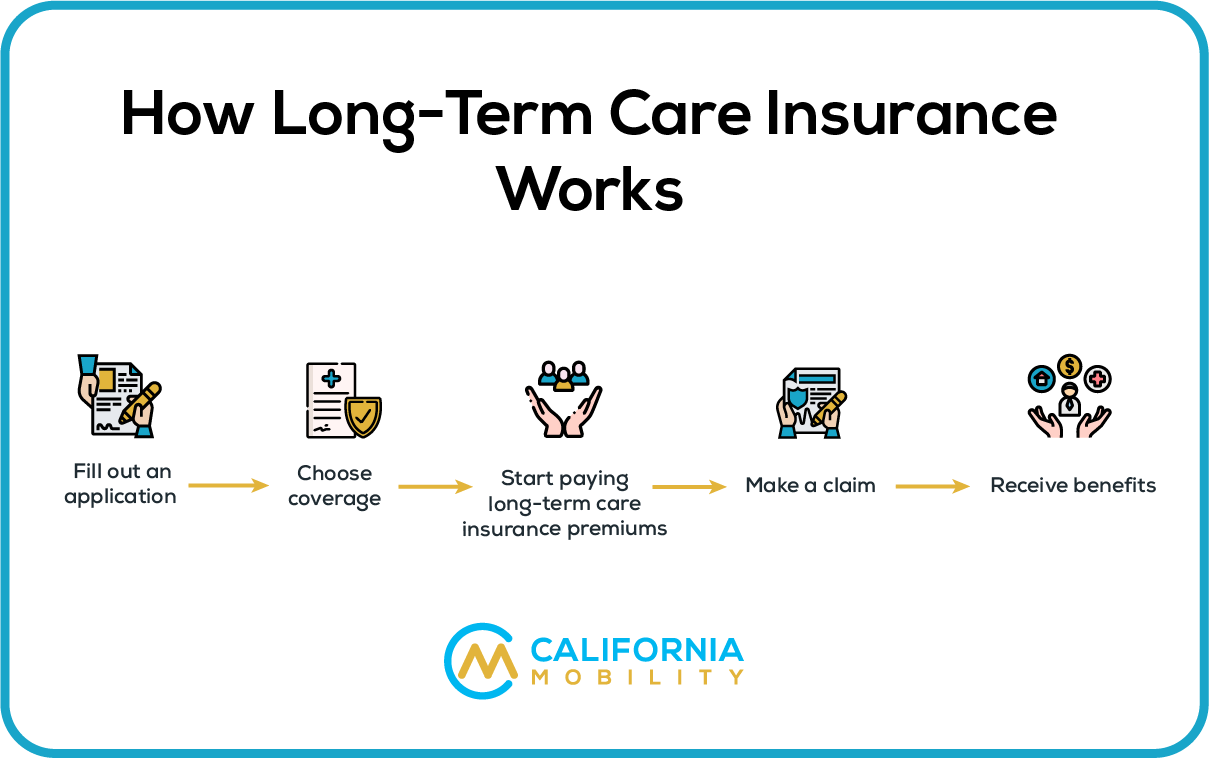

How Long-Term Care Insurance Works

Ready to take the plunge? Here’s how long-term care insurance works.

First, you’ll have to fill out an application and answer health questions, just as you might when applying for similar coverage, like life insurance. You’ll often be required to submit medical records or to complete an interview, either over the phone or face-to-face.

You can then choose how much coverage you want. Often, the policies cap how much is paid out per day and how much is paid out over a lifetime.

After you’re approved for coverage, you start paying long-term care insurance premiums. You will usually be eligible for benefits when you can’t complete a minimum of two to six activities of daily living independently. This could be because of a physical impairment or because you suffer from a cognitive impairment – in fact, dementia and Alzheimer’s often qualify you for benefits regardless of your ability to complete daily living tasks.

The activities of daily living that qualify for benefits include eating, dressing, bathing, toileting, caring for incontinence, adn transferring (which is the act of getting out of a chair or bed).

Once you’re ready to make a claim and decide that you need care, the insurance company will review the medical documents from your doctor. They might send over a nurse for an evaluation but before approving your claim, your insurer will have to approve your plan of care.

There’s a good chance that you’ll have to pay for services out of pocket for a certain number of days before you are reimbursed for any of these long-term care expenses – so don’t deplete your savings now assuming that all of your care will be covered. Known as the elimination period, there is a gap of 30-90 days in which you’ll have to foot the bill.

The policy will begin to provide you with reimbursement after you’re eligible for benefits, with most paying up to a daily limit for care until you reach the lifetime maximum. There are even some policies that offer shared care options for couples so that spouses can share the total amount of coverage – a major benefit if one spouse ends up needing care and the other does not.

You can buy long-term care insurance through an agent or directly from a company. In many cases, you can also buy a policy at work. Some employers offer the ability to purchase coverage at group rates – this often makes it easier to qualify. Again, it’s still important to get multiple quotes.

Annual Cost of Long-Term Care Options

The rates you pay depend on a variety of things, including:

- Your age and health. The older you are and the more health problems you have, the higher your premiums will be when purchasing insurance policies.

- Marital status: Even if you’re not purchasing a shared care option, premiums tend to be lower for married people than for single individuals.

- Amount of coverage: Of course, you’ll pay more for more coverage – with higher litmus on daily or lifetime benefits, shorter elimination periods, fewer restrictions on the type of care that is covered, and cost of living adjustments, naturally, you’re going to pay more.

- Insurance company: Shop around – prices for the same type of coverage will vary depending on where you buy. Make sure you compare quotes before you take the plunge.

- Gender. Women generally pay more than men because they live longer and face an increased chance of making long-term care claims at some point in their lives due to gender-specific risk factors like childbirth or breast cancer which can lead to extended hospital stays over time. However, this does not mean that women should accept these high costs just because they’re female – it is possible for them to research other options such as investments through IRAs (Individual Retirement Account) where there may be protection against inflation risks related with future healthcare needs.

Still not sure what to expect? Here’s an example – a 55-year old man in good health can expect to pay an average of $2,050 for a long-term care policy with an initial pool of benefits at 164k. The benefits compounded annually will be worth 386K by the time they’re 85 years old!

Just keep one thing in mind. The price of your policy could go up after you buy it, as insurance companies are not always able to predict the cost of claims over time. Many people saw their rates spike in the last few years because insurers were asking state regulators for permission to hike premiums. This is common – they blame this on costs being higher than expected and justify rate increases by using that excuse.

Long-term care insurance can be a wise investment for those wanting to save on taxes – if this is you, you may want to meet with a financial advisor to find out which premiums and other expenses are tax-deductible.

In most cases, though, the IRS allows people over the age of 65 to count up to 100% of their long-term care premiums as medical expenses and deduct them from their taxable income, with limits increasing by 5% per year starting at 70 years old. This tax deduction is especially important if you itemize your deductions because it may give you greater flexibility in how much state or local sales tax expense (and property) qualifies for this exemption too!

Long-term care insurance is an excellent way not only to manage healthcare costs but also lower one’s federal and some states’ taxes due each year–especially once reaching retirement age where these exemptions are doubled every five years.

Cost of Long-Term Care Insurance

Although the cost of long-term care insurance is by no means prohibitive, it’s not the best option if you have a low income and very little savings to speak of. It’s generally recommended by experts like the National Association of Insurance Commissioners that you spend no more than five percent of your income.

The bad news about buying long-term care insurance is that since it is a relatively new concept, there aren’t that many insurance companies that specialize in selling it – it isn’t nearly as ubiquitous as car, home, or health insurance.

In addition, the number of insurance companies selling long-term care insurance has dropped sharply. Although more than 100 insurers sold these policies in the 1990s, there are less than a dozen that offer them today – this was due in part to the low interest rates and uncertainty of paying future claims since the 2008 recession. Currently, you can access policies through the following companies:

- Northwestern Mutual

- Transamerica

- Mutual of Omaha

- MassMutual

- Genworth Financial

- Bankers Life and Casualty

- New York Life

Is Long-Term Care Insurance Worth It?

There’s no right answer about whether or not you should purchase long-term care insurance. In fact, the pros and cons are pretty evenly balanced – meaning it can be super tough to make a decision!

Determining whether long-term care insurance is worth it is 100% a personal preference. It’s a relatively new concept, so pricing has been a major concern as companies navigate the best pricing models and systems to give customers what they need – while also balancing their bottom lines.

Because of this, there’s a lot of financial uncertainty surrounding the idea of premiums. A premium that you are paying now could very well change over time – and there’s still confusion over how to price different plans. You might receive vastly different quotes from different companies.

That said, investing in long-term care insurance can provide you significant peace of mind. Once you’ve taken out a plan, you can rest easy knowing that your family will have the funds to support you as your health declines and you begin to age. You won’t have to worry about how your family will help you out if you need to go into an assisted living facility or require home health services.

Of course, it can be tough to figure out the exact amount of insurance you need. How are you to know what will happen when you’re 90 or what kinds of health conditions you might have? Heck, you might not even still be alive at 90 (it’s a morbid thought, but one we’ve certainly all had!).

Long-term care policies won’t insure you in all cases – they will only pay a certain, fixed price for a fixed period of time. If you have a plan that guarantees $100,000 in benefits, there’s no saying that amount will be sufficient. But if you purchase additional benefits, there’s no guarantee that you will use all of them, or use them at all – and that money will go to waste when it could be funding some others expect of your lifestyle (like retirement travel).

It also has an elimination period, or a length of time between your health episode and injury and when you can receive benefits. For example, if you enter a nursing home for two months, there’s the chance that you might not receive benefits the entire time you are there.

There’s always the chance that you might not qualify. Like life insurance, most long-term care insurance providers require that applicants complete and pass a physical before they agree to insure you. Nearly a fifth of all applicants are denied coverage – and keep in mind that pre-existing health conditions can not only get you a denial, but also jack up your rates.

What Age Should You Buy Long-Term Care Insurance?

There’s no single best age to buy long-term care insurance, but to avoid being hit with exorbitant expenses, it’s important that you start shopping around now.

Some people shop based on the principle of the early bird getting the worm – and while that’s wise, it can be a bit disadvantageous to be too eager. Enroll in a policy in your 40s or early 50s, and yes, you will pay lower premiums. However, you’ll be paying them for nearly two decades before you file a claim. Instead, wait until the sweet spot – the ideal time to start paying for a long-term care policy, assuming you are in good health, is around the age of 60 to 65.

This “sweet spot” will entitle you to low premiums that are still affordable each month coupled with a total premium savings. Plus, it won’t be so late that you have to worry about not qualifying.

Conclusion

Still can’t decide whether long-term care insurance is right for you? If you have the extra funds and want to guarantee that you will be protected in the future, it might be a worthy investment. After all, the American Association for Long Term Care Insurance estimates that nearly 70% of adults older than 65 will need long-term care.

To make things even more worrying, Genworth, a provider of insurance for long term care, estimates the average daily cost of long term care to be as high as $297 per day – not per month, not per week, but per day.

Insurance is a good way to make sure you are cared for as you age – without significant hardship or burden for your family members. Consider long-term care insurance (or one of its alternatives, like deferred annuities) as you plan for your future, and you’ll be able to rest easy at night knowing everything is taken care of.