How to Help a Senior Loved One With Debt

Table of Contents

Managing a senior loved one’s finances can be a delicate, challenging task, especially when faced with social security, health care, and estate planning issues. This blog post aims to help adult children and caregivers deal with such scenarios. We’ll explore various topics – from assessing your parent’s financial situation to creating a debt management plan and how to support them emotionally through the whole process.

Key Takeaways

- Create a clear debt repayment strategy by prioritizing high-interest debts and negotiating with creditors for better terms to simplify the process.

- Promote frugal living, set up automatic bill payments, and stay alert to scams to reduce expenses and protect financial information.

- Support your loved ones in managing finances and providing emotional support. Encourage open conversations about money and reassure them during financial challenges.

Initiating the Conversation

Initiating a conversation about your parent’s finances can be challenging, yet it is an essential first step. It’s critical to approach the subject with empathy, understanding, and respect for their independence and feelings.

Make it clear that you’re there to assist them in managing their financial situation, not usurp control. Talk openly about their debt, credit card usage, insurance policies, and any legal documents like power of attorney.

It can be helpful to involve a third party, such as a financial planner or an elder law attorney, who can provide professional advice and facilitate these discussions.

Remember, the goal is to create a collaborative environment where your parents feel comfortable discussing their financial situation, thus paving the way for effective financial planning and debt management.

Assessing Your Loved One’s Finances

Once the conversation about finances has been initiated, the next critical step is to assess your loved one’s financial situation. This process involves clearly understanding their income sources, including social security, pensions, and retirement accounts. Double-check their bank account numbers, checking account amount, and savings as well.

Along with this, it’s important to delve into the details of their monthly expenses. This means looking at bills, premiums, mortgage or rent, and daily living costs.

Here are some important aspects to keep in mind:

- Discuss any outstanding debts, such as credit card debt or loans, and understand their repayment plans.

- Be aware of any insurance policies or legal documents like directives and wills, as these can shed light on their financial health.

A thorough assessment of these varied factors is essential for creating a robust and effective debt management plan.

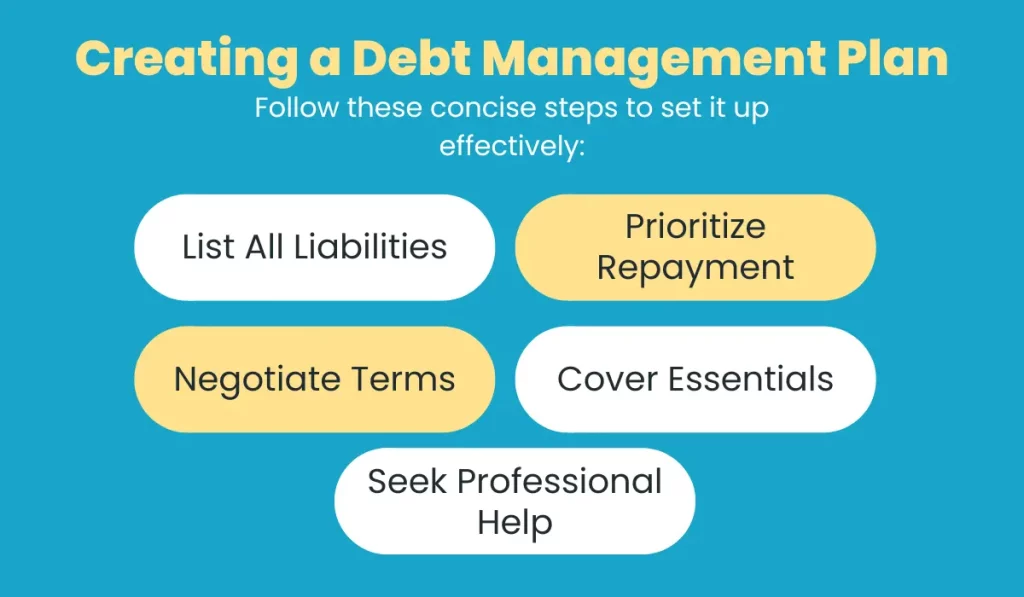

Creating a Debt Management Plan

A well-thought-out debt management plan is crucial for guiding your loved one through their financial challenges. Follow these concise steps to set it up effectively:

- List All Liabilities: List every debt, including credit card balances, mortgages, loans, and other obligations. Note the interest rates for each.

- Prioritize Repayment: Use the “avalanche method” to pay off high-interest debts first or the “snowball method” to start with the smallest debts for motivational gains.

- Negotiate Terms: Reach out to creditors to discuss better repayment terms or lower interest rates to ease the financial burden.

- Cover Essentials: Ensure all monthly expenses and necessary bills are managed, and consider setting up an emergency fund for unexpected costs.

- Seek Professional Help: Consider consulting a certified credit counselor or financial planner for a tailored and more efficient debt management strategy.

These steps will help create a structured and manageable approach to your family member’s debts.

Preventing Future Financial Challenges

Proactive financial planning and regular monitoring are key to avoiding future financial challenges for your loved ones. Begin by guiding them towards a more frugal lifestyle, focusing on cutting down unnecessary expenses. If they are comfortable with the idea, setting up automatic bill payments can be a great step to prevent late fees and missed payment penalties.

It’s also essential to be vigilant against scams targeting the elderly. Educate them about the risks of unsolicited calls and emails that may seek personal financial information. Introducing basic internet security practices can be highly beneficial if they’re using online banking or payment platforms.

A few ideas to note:

- Regular family meetings about finances promote transparency and keep everyone informed about the current financial situation.

- Preparation and open communication are vital to navigating and preventing potential financial issues in the future smoothly.

Providing Emotional Support

Managing finances and debt can be stressful and emotionally taxing for your elderly loved ones. You mustn’t be just there to help with the numbers but also to provide emotional and social support.

Encourage open and non-judgmental conversations about money, allowing them to express any worries or fears they might have.

Reassure them that facing financial difficulties is okay and remind them that you’re there to navigate these challenges together. In times of financial stress, simple acts of kindness can make a big difference – a listening ear, a comforting word, or a reassuring hug can go a long way.

Consider involving a mental health professional if your loved one seems overly anxious or depressed about their financial situation. Remember, while you’re helping manage their financial affairs, you’re also there to ensure their emotional well-being.

Helpful Resources and Links

Navigating complex financial management for the elderly can be challenging, but you don’t have to do it alone. Here are some valuable resources that offer guidance and support:

- National Council on Aging (NCOA): As a leading advocate for older adults, the NCOA offers extensive information on financial topics like debt management and budgeting. Learn more about the NCOA.

- Debt.org for Seniors: Get tailored advice on debt consolidation and management for seniors. Visit Debt.com for Seniors.

- AARP Guide to Public Benefits: A comprehensive resource from AARP that helps seniors access public benefits and assistance programs. Explore the AARP Guide to Public Benefits.

These resources are there to support you and your loved ones in managing financial challenges effectively.